The Ultimate Guide to Coding, Optimizing & Automating Trading Strategies

Published on: March 2, 2025

The Ultimate Guide to Coding, Optimizing & Automating Trading Strategies

In today’s rapidly evolving financial markets, successful algorithmic trading depends on more than just a good idea—it requires a robust framework for developing, optimizing, and automating your trading strategies. Whether you’re a retail trader, a seasoned algo enthusiast, or a part of a professional trading firm, choosing the right platform is crucial for long-term success. In this comprehensive guide, we’ll cover everything from TradingView and MetaTrader to custom solutions built with Python or C++. We’ll discuss key topics such as overfitting, machine learning, train-test-validation, forward testing, heatmaps for parameter optimization, backtesting, risk management, and the essentials of trading automation.

Our goal is to help you understand the strengths and weaknesses of each platform and to guide you through best practices so you can trade smarter with minimal hassle. Let’s dive into the best solutions for coding, optimizing, and automating your trading strategies.

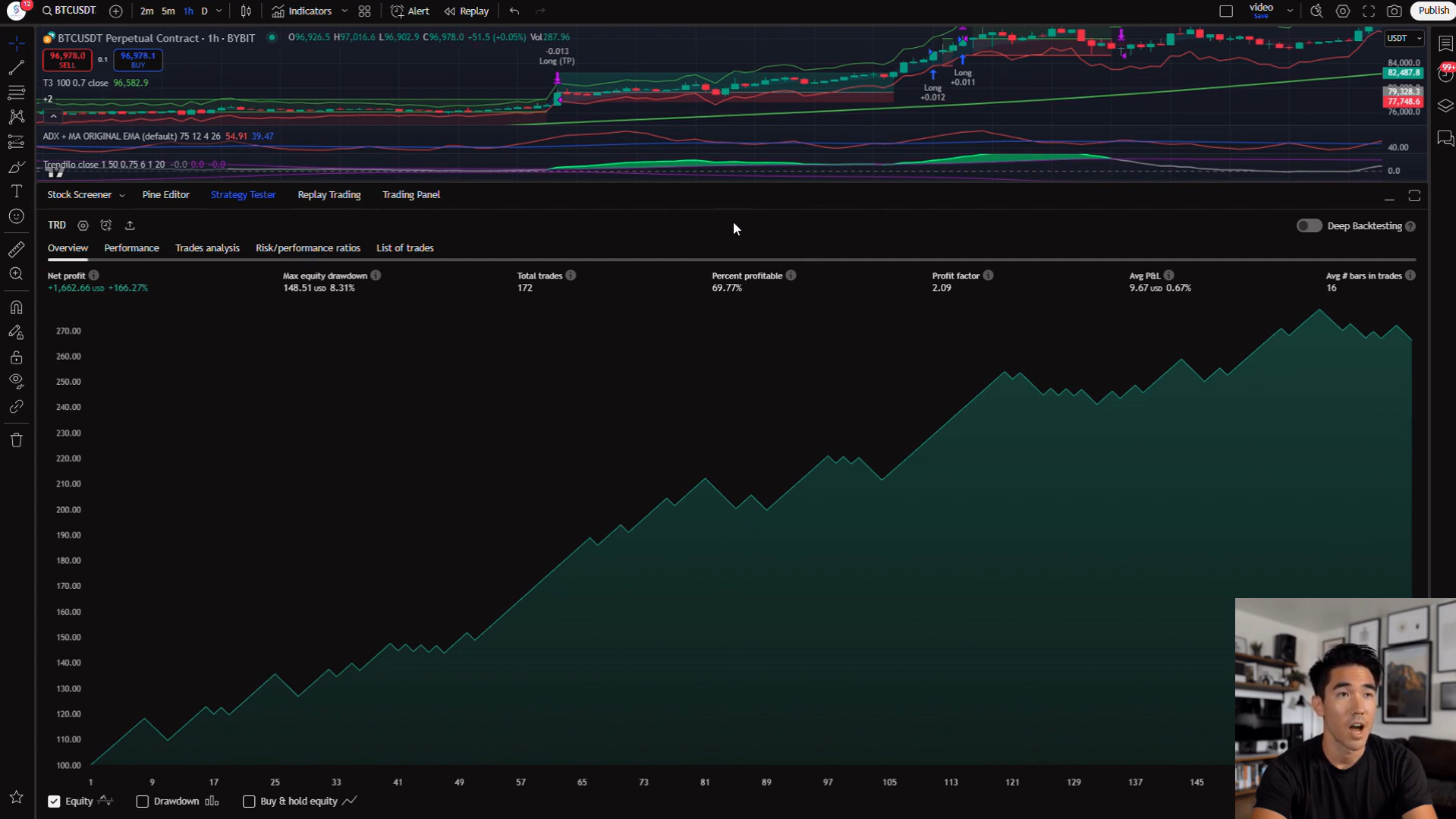

1. TradingView: Rapid Strategy Development and Backtesting

TradingView has emerged as one of the most popular platforms for both beginner and professional traders. With its intuitive interface and extensive library of community-created scripts, it’s easy to see why TradingView is a top choice for developing trading strategies.

Key Features:

- Rapid Strategy Prototyping: TradingView’s built-in scripting language, Pine Script, lets you code, test, and deploy strategies quickly. The platform is designed to let you build and backtest strategies in minutes.

- Large Open-Source Community: With millions of traders sharing ideas, TradingView offers a vast library of indicators and strategies. This open community fosters collaboration and innovation, making it easier to learn new techniques.

- Integrated Backtesting: TradingView’s strategy tester provides detailed backtesting results with metrics like net profit, drawdowns, and win rates. This built-in tool is ideal for evaluating automated trading systems before you commit to live trading.

- Ease of Use: Its cloud-based nature means you can access your strategies anywhere, and it’s especially attractive for traders who want to experiment with machine learning approaches and parameter optimization without heavy technical overhead.

Limitations:

- Restricted Data Access: Pine Script operates on bar data, limiting ultra-high-frequency strategies. It also lacks native integration for external data, which can be crucial for advanced train-test-validation and forward testing.

- Automation Constraints: While TradingView can trigger alerts, fully automated trading often requires connecting to brokers through third-party services. This means you may need additional tools, such as Tickerly, to bridge the gap.

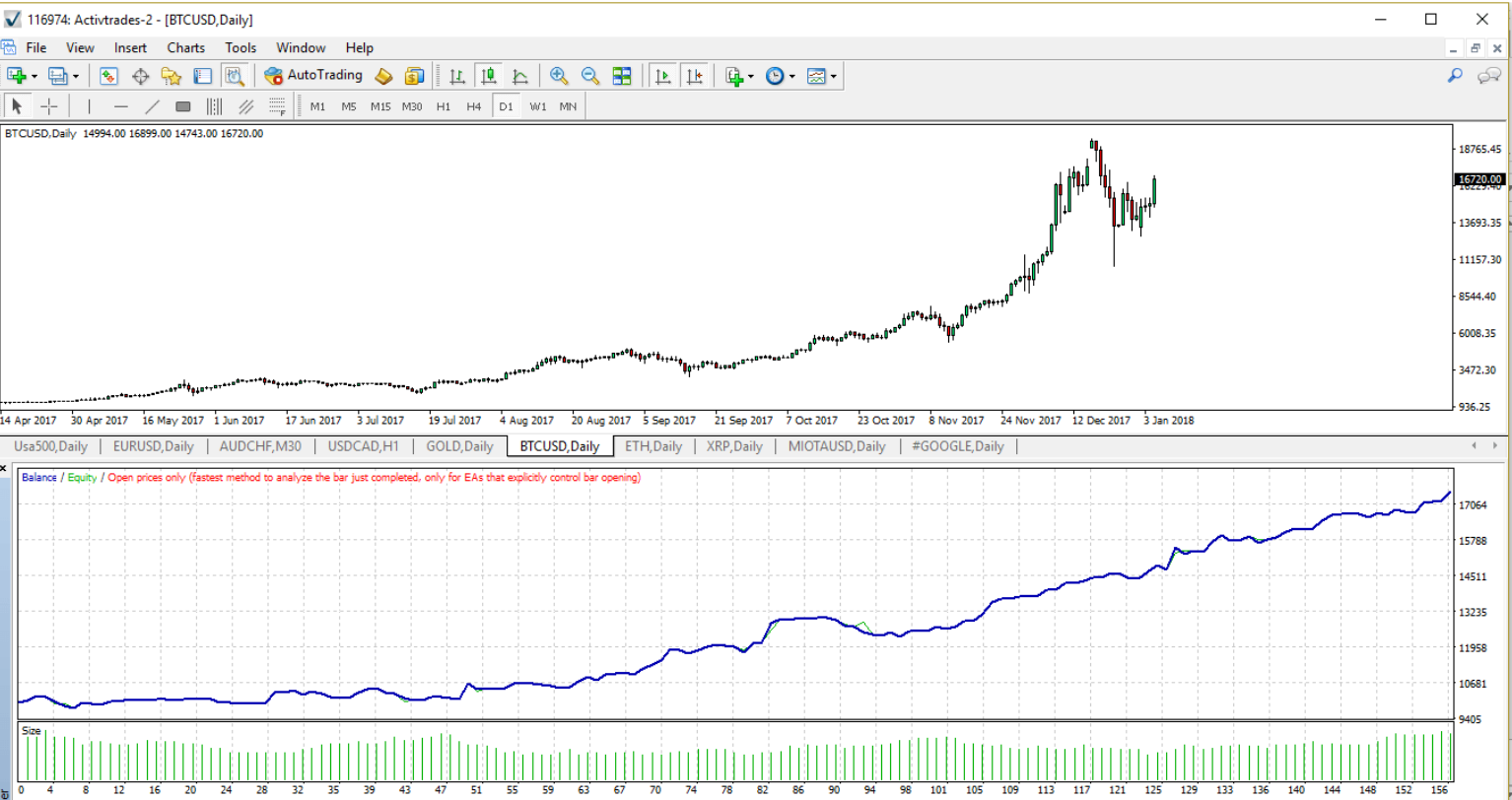

2. MetaTrader: The Veteran Platform for Automated Trading

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) have long been industry standards in forex and CFD trading. Known for their robust features, these platforms support automated trading through Expert Advisors (EAs) coded in MQL4 and MQL5.

Advantages:

- Powerful Backtesting & Optimization: MetaTrader’s strategy tester is one of the most powerful tools available, offering multi-threaded backtesting and cloud computing options. This allows extensive parameter optimization using techniques that can run thousands of iterations rapidly.

- Comprehensive Automation: Once an EA is tested, it can execute trades automatically on live accounts. This ensures that your algorithmic trading system is running 24/7, handling orders with precision.

- MQL Programming: MQL4 and MQL5, similar to C++, offer advanced scripting capabilities. With these languages, you can code complex strategies that incorporate risk management rules and precise execution logic.

Drawbacks:

- Dated User Interface: Despite its robust functionality, MetaTrader’s interface remains reminiscent of early 2000s software. (Traders often joke that using MetaTrader feels like operating a vintage DVD player—functional but not exactly cutting-edge in looks!)

- Steeper Learning Curve: Compared to TradingView, learning MQL can be challenging, particularly for traders who are new to coding.

3. Custom-Built Solutions: Python, C++, and Beyond

For traders seeking maximum flexibility, building your own trading platform using Python, C++, or C# is an attractive option. This approach offers unparalleled control over every aspect of your strategy, from machine learning model integration to advanced backtesting and risk management techniques.

Benefits:

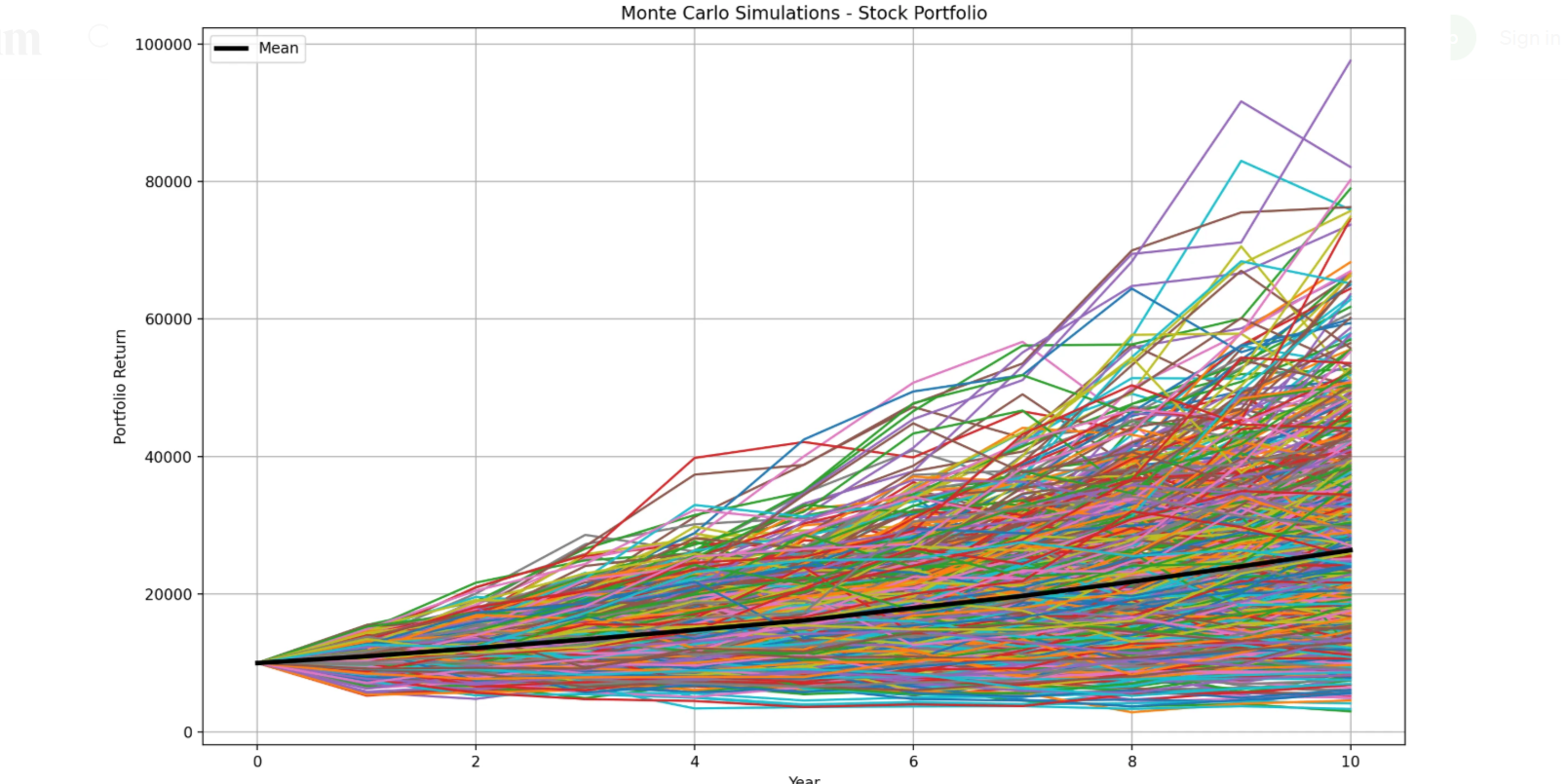

- Ultimate Flexibility: Custom coding allows you to incorporate sophisticated models and external datasets into your trading strategy. You can implement complex train-test-validation schemes and perform forward testing exactly as needed.

- Advanced Optimization Techniques: With languages like Python, you can use libraries such as scikit-learn, TensorFlow, or PyTorch to optimize your strategy parameters using advanced machine learning techniques and visualize performance using heatmaps.

- Low Latency Execution: For high-frequency trading, C++ offers the speed and efficiency required to execute trades with minimal latency. This can be a significant advantage in fast-moving markets.

Challenges:

- High Technical Barrier: Building a custom solution requires advanced programming skills. It’s not as accessible as platforms like TradingView or MetaTrader.

- Time and Resource Intensive: Developing, testing, and maintaining your own system can be a lengthy process. You must handle everything from data management to error handling and server infrastructure for continuous operation.

- Risk of Overfitting: Without proper safeguards, custom solutions can easily fall into the trap of overfitting. Using techniques like train-test-validation, forward testing, and visualizing results with heatmaps is critical to developing a robust strategy.

4. Additional Platforms for Algorithmic Trading

While TradingView, MetaTrader, and custom-built solutions are widely popular, several other platforms deserve mention:

- NinjaTrader: A Windows-based platform using C# (NinjaScript) that offers advanced charting, backtesting, and optimization tools. It strikes a balance between usability and technical power.

- QuantConnect: A cloud-based platform that allows you to code in Python or C# using its Lean Engine. It provides extensive historical data for backtesting and supports multi-asset classes.

- Zorro Trader: A lightweight, free platform that supports a C-like scripting language and integrates with external tools for machine learning and heatmap analysis. It is especially popular among hardcore algorithmic traders.

- AmiBroker: Known for its fast optimization engine and scripting language (AFL), AmiBroker is ideal for those who require heavy parameter optimization and data scanning.

- MultiCharts and TradeStation: These platforms use EasyLanguage, offering an easier learning curve while still providing robust backtesting and automated trading features.

Each platform offers a unique blend of accessibility and optimization depth. The best choice depends on your technical skills, strategy complexity, and specific trading requirements.

5. Best Practices: Avoiding Overfitting and Enhancing Risk Management

Developing a profitable trading strategy isn’t just about coding; it’s about ensuring that your strategy performs reliably under various market conditions. Two key elements in this process are avoiding overfitting and implementing strong risk management practices.

Avoiding Overfitting:

- Train-Test-Validation: Split your historical data into separate segments for training, testing, and validation. This ensures that your strategy isn’t merely tailored to past data but has real predictive power.

- Forward Testing: After backtesting, run your strategy on live or paper trading data to see how it performs in real-time. This step is critical before committing real capital.

- Heatmaps for Parameter Optimization: Use heatmaps to visualize the performance of your strategy across different parameter combinations. A robust strategy should perform well over a broad range of values rather than showing optimal results for one narrow setting.

Enhancing Risk Management:

- Position Sizing: Limit risk by carefully determining the percentage of capital allocated to each trade. This minimizes the impact of a single losing trade.

- Stop Losses and Take Profits: Implement clear exit strategies to protect your capital from market volatility.

- Diversification: Don’t rely on a single strategy. Use a portfolio approach by running multiple, uncorrelated strategies to smooth out overall performance.

- Regular Monitoring: Even automated systems require periodic review to ensure they continue to perform as expected, particularly in rapidly changing market conditions.

By incorporating these practices into your automated trading setup, you can mitigate risks and improve the longevity of your strategy.

6. Bringing It All Together: Your Path to Successful Automated Trading

The journey to mastering algorithmic trading involves selecting the right platform, coding a robust strategy, and ensuring rigorous testing and risk management. Here’s a quick recap:

- TradingView is ideal for rapid prototyping, backtesting, and learning the basics of trading strategies.

- MetaTrader offers a proven, all-in-one solution for automated trading with powerful optimization tools, despite its retro interface.

- Custom Solutions built in Python or C++ provide ultimate flexibility and integration, perfect for those who need to leverage advanced machine learning and parameter optimization techniques.

- Other platforms like NinjaTrader, QuantConnect, Zorro Trader, and AmiBroker offer additional avenues for specialized needs and preferences.

No matter which platform you choose, remember to focus on avoiding overfitting by using solid train-test-validation methods and forward testing. Utilize heatmaps to fine-tune your parameters and always incorporate comprehensive risk management strategies to protect your capital.

At Sferica Trading, we understand that building and optimizing effective trading strategies is not for the average trader. Our team uses advanced, bi-dimensional heatmaps and rigorous machine learning techniques to develop strategies that are proven in both backtesting and live trading environments. We believe in transparency, robust risk management, and continuous innovation to ensure our subscribers get the best edge in automated trading.

Final Thoughts

The future of algorithmic trading is bright, with a vast ecosystem of platforms that cater to every level of expertise—from beginners to advanced quants. Whether you’re just starting out on TradingView, automating your trades through MetaTrader, or developing your own sophisticated system in Python, the right tools and techniques can transform your trading experience.

For traders eager to harness the power of trading automation and cutting-edge machine learning techniques, it’s time to explore professional-grade solutions. Visit Sferica Trading to learn more about our premium trading strategies, optimization tools, and automation services. Join our community, avoid the pitfalls of overfitting, and take your trading strategy to new heights with expert insights and state-of-the-art technology.

By leveraging the insights in this guide, you can confidently choose the platform that best suits your needs and develop a robust, scalable, and profitable trading strategy. Embrace the future of automated trading and let technology work for you 24/7.

Happy Trading!

Ready to Automate Your Trading?

Explore our plans and start your 14-day free trial today.

View PricingTable of Contents

- 1. TradingView: Rapid Strategy Development and Backtesting

- Key Features:

- Limitations:

- 2. MetaTrader: The Veteran Platform for Automated Trading

- Advantages:

- Drawbacks:

- 3. Custom-Built Solutions: Python, C++, and Beyond

- Benefits:

- Challenges:

- 4. Additional Platforms for Algorithmic Trading

- 5. Best Practices: Avoiding Overfitting and Enhancing Risk Management

- Avoiding Overfitting:

- Enhancing Risk Management:

- 6. Bringing It All Together: Your Path to Successful Automated Trading

- Final Thoughts