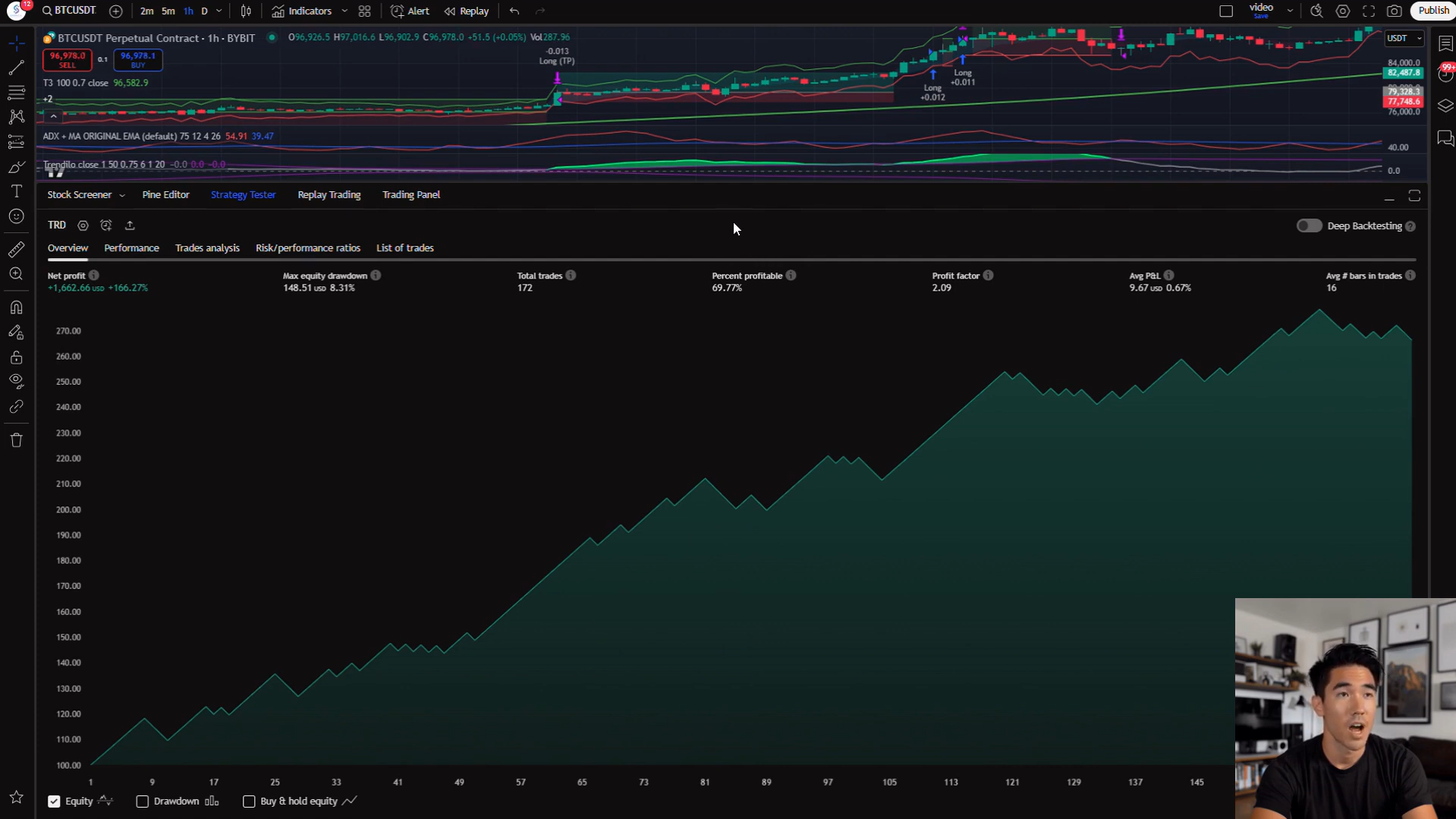

Discover the Power of the Trendilio Strategy in Algorithmic Trading

Published on: February 15, 2025

Unlock a new level of trading precision with our innovative strategy built around the rarely-used Trendilio indicator. In this video, Mat from Sferica Trading breaks down a unique approach that combines advanced indicators with proven risk management techniques to deliver consistent, data-driven trade signals.

Watch the Trendilio Strategy in Action

Strategy Overview

Our Trendilio strategy is designed for traders who demand clarity and efficiency in the market. This powerful method integrates several key technical tools to create a robust, automated trading system:

- T3 Moving Average (Length: 300):

Serves as the trend filter. When the price is above the T3, only long trades are considered; when below, short trades are taken. - Trendilio Indicator:

More than just a typical oscillator, Trendilio adapts in real time. A green signal (when the line crosses above zero) indicates bullish momentum for long entries, while a red signal (when it dips below zero) signals a short opportunity. - ADX + Moving Average Confirmation:

The Average Directional Index (ADX) coupled with its moving average confirms the strength of the trend. Only when the ADX is above its moving average do we take a trade, ensuring that weak signals are filtered out. - ATR Bands for Risk Management:

Stop-loss levels are dynamically set using ATR Bands with a 2x multiplier, adapting to market volatility. Profit targets are defined by either a minimum gain of 1% or a 1:2 risk-to-reward ratio.

This systematic approach ensures that every trade is taken with clarity, precision, and confidence—removing the guesswork from your trading routine.

See the Strategy in Action

.png)

Why This Strategy Works

- Clear Trend Identification:

The T3 Moving Average ensures that you’re trading with the market's direction, avoiding counter-trend trades. - Dynamic Entry Signals:

Trendilio’s adaptive nature provides timely entry points, letting you capitalize on market momentum. - Robust Confirmation:

The ADX combined with its moving average filters out weak signals, ensuring that only strong, actionable trends are traded. - Intelligent Risk Management:

Using ATR Bands to set stops means that your risk is always adjusted to current market volatility, protecting your capital while maximizing potential gains.

This strategy reflects the core of what we do at Sferica Trading—developing advanced, automated trading strategies that deliver real results. If you’re looking to improve your trading edge with innovative methods and precise execution, this is the strategy for you.

Ready to Trade Smarter?

Visit Sferica Trading for more cutting-edge trading strategies, in-depth tutorials, and automated trading tools. Whether you’re a beginner or an experienced trader, our platform offers the resources you need to succeed in today’s dynamic markets.

Ready to Automate Your Trading?

Explore our plans and start your 14-day free trial today.

View Pricing