The McGinley Dynamic: A Revolutionary Trading Strategy

Published on: February 2, 2025

Discover how the McGinley Dynamic indicator transforms trading strategies by adapting to market speed and volatility in real time.

INTRODUCTION

In this article, we dive deep into the McGinley Dynamic trading strategy—a unique, adaptive approach designed to overcome the limitations of traditional moving averages. Developed by the Sferica Trading team, this strategy uses the McGinley Dynamic as its backbone, complemented by other powerful indicators, to deliver consistent performance in live markets. Whether you're trading crypto, forex, or stocks, this strategy offers precision, adaptability, and transparency.

Watch the full video below for a comprehensive walkthrough:

What Is the McGinley Dynamic Indicator?

The McGinley Dynamic is not just another moving average. Unlike simple (SMA) and exponential moving averages (EMA), it adapts to market speed in real time. Originally designed as a smoothing tool, its unique algorithm minimizes lag and false signals, making it a game-changer for traders who demand accuracy.

Key Benefits:

- Adaptive Smoothing: Automatically adjusts to fast or slow market conditions.

- Reduced Noise: Minimizes whip-saw movements for clearer trend signals.

Real-Time Performance: Tracks price action more accurately than traditional moving averages.

How the Strategy Works

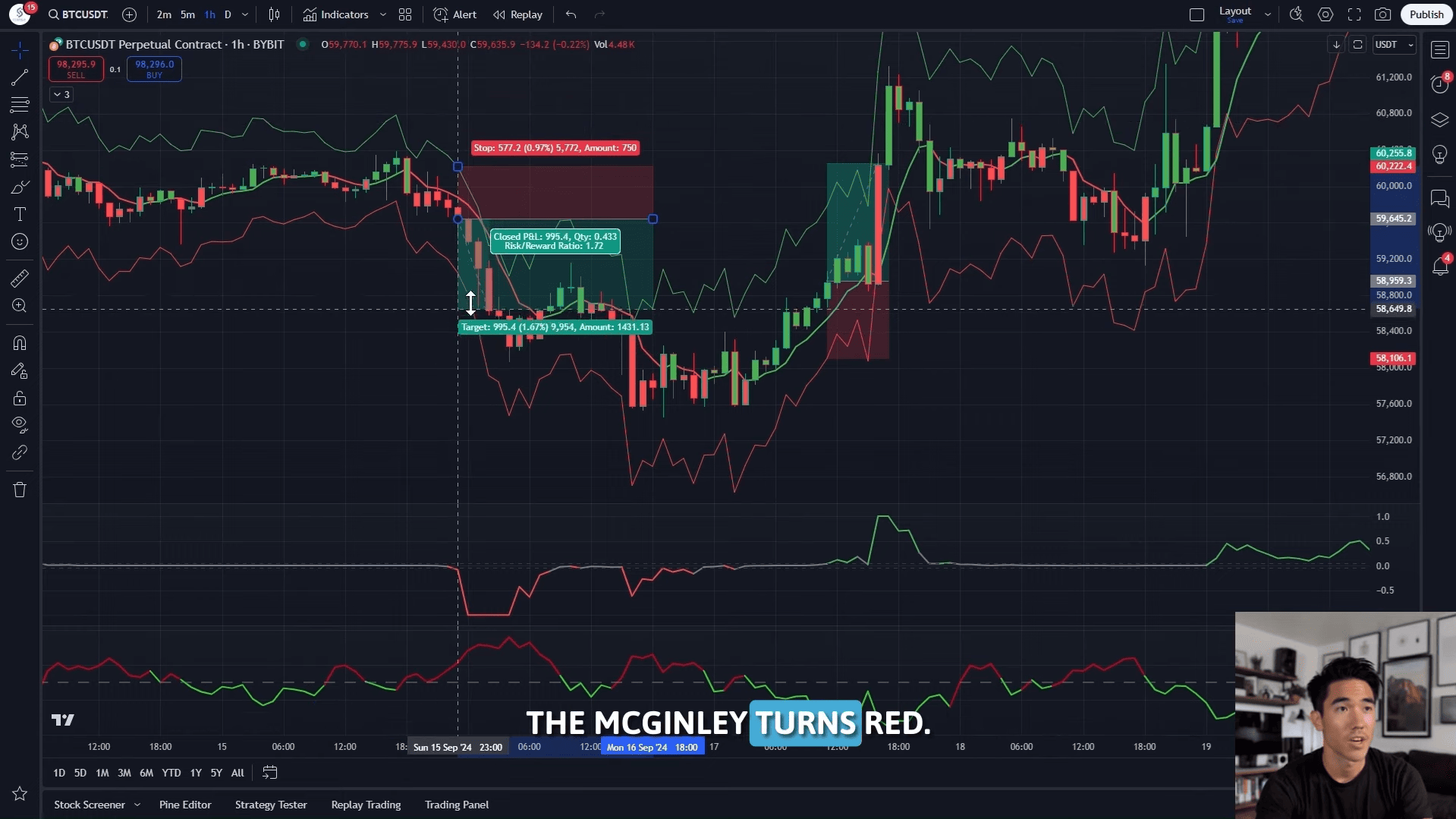

The strategy combines the McGinley Dynamic with several confirmation indicators to form a robust trading framework:

1. Trend Direction:

When the McGinley line turns green, it signals a long (buy) opportunity.

When it turns red, the focus shifts to short (sell) trades.

2. Risk Management with ATR Bands:

ATR bands help dynamically set stop-loss and take-profit levels based on current market volatility.

3. Momentum Confirmation:

The Trend Direction Force Index (TDFI) confirms market momentum, ensuring that trades align with the prevailing trend.

3. Market Trend Verification:

The Larry Williams Proxy Index further validates the dominant market trend before executing a trade.

For a visual example, check out the screenshots below:

Performance & Results

Backtested across various asset classes—from crypto and forex to stocks—the McGinley Dynamic strategy has consistently shown impressive results. Key performance metrics include:

- Profit Factor: Ranging between 1.7 and 2.2

- Win Rate: Consistently at 60% or higher

These numbers underscore the strategy’s effectiveness in delivering real, live market results—not just theoretical backtests.

Why Choose the McGinley Dynamic Strategy?

1. Precision and Adaptability

By automatically adjusting to market conditions, this strategy minimizes lag and false signals, ensuring timely entries and exits.

2. Comprehensive Risk Management

The integration of ATR bands for stop-loss and take-profit levels provides a dynamic and effective risk management system that adapts to market volatility.

3. Verified Live Performance

Unlike many strategies that only look good on paper, every trade executed with this system has been live-traded, with full transparency in performance data.

Conclusion

The McGinley Dynamic trading strategy by Sferica Trading represents a significant advancement in algorithmic trading. It combines adaptive indicators, robust risk management, and real-time market responsiveness to provide a trading edge in volatile markets.

Ready to elevate your trading game?

Visit https://sfericatrading.com/ to learn more and explore our full suite of automated strategies and trading tools.

Stay ahead of the market with cutting-edge strategies and transparent performance. Happy Trading!

Ready to Automate Your Trading?

Explore our plans and start your 14-day free trial today.

View Pricing